8+ Non Resident Mortgage Canada

You may have questions about real estate but youve come. This means you will require 35 down payment.

The Trigger Rate Explained

For Canadian non resident mortgage loan financing options call 416 464 4113 and speak directly to Toronto mortgage broker Joe Walsh.

. Here are the mortgage options you have in the US as non. Effective April 21 2017 a 15 tax is imposed on the purchase of. Qualifying for a Mortgage as a Non-permanent Canadian Resident.

What documents do non-residents need to provide for a Canadian mortgage. Can Non-Resident Aliens Get a Mortgage. For the most part provided they meet the mortgage eligibility criteria non-residents can access the same mortgage products that are available to residents of Canada.

As a Non Canadian or Non Permanent Resident there are mortgage options for you. Now the most important question is can you get a mortgage in Canada as a non-resident. Normally customarily or routinely live in another country and are not considered a resident of Canada.

To be considered a non-resident you must live outside of Canada for at least 6 months a year. Residents at least 20 down payment is required. Every mortgage is unique and well help you find the best fit.

In order to qualify for a mortgage as a non-resident you will require the following. Even if you are not a permanent resident of Canada there is no reason that you cannot have a high income and. To get a mortgage in BC Canada as a non resident you need to choose a lender and provide the following.

A reference letter from your bank. You are a non-resident for income tax purposes if you. Canadas real estate market is open to just about.

A reference letter from your bank. As a non-resident your loan may require. A 35 down payment with proof the funds were not gifted.

The above Annual Percentage Rates APR for our special offers are compounded semi-annually not in advance. If you plan to live in Canada in the near future click here for information about new to Canada mortgages. If you are a non-resident acquiring real estate in Canada there are options to enter into an investment property.

This applies even to Canadian ex-pats who have found their home elsewhere. Below we explain some important information youll want. As a non-resident documentation is needed to qualify for a mortgage in Canada.

647 933 1090 Home. Contact me today to find out. As a non-resident buying real estate in Canada specifically in certain parts of Ontario you may be subject to NRST.

To see if you qualify contact us and we. You may qualify for a mortgage for a home in Canada up to 65 LTV. Typically the minimum will be set anywhere from 20 and up as opposed to lower down payment amounts that residents are able to access.

604 771 5192 or iainyourvancouvermortgagebrokerca LESS HASSLE. The rate for an American opting for a non. A 35 down payment.

Yes as a non-resident you are eligible to apply for a mortgage. Each APR calculation is based on a mortgage of 100000 with a 25 year.

Non Resident Mortgage In Canada Start Here Globalbanks

Mortgage Underwriter Resume Samples Velvet Jobs

Non Resident Buyers What You Need To Know About Buying Property In Canada Mortgages Ca

4694 W 8th Ave Vancouver For Sale R2736086 Strawhomes Com

Non Resident Mortgage True North Mortgage

Getting A Non Resident Mortgage In Canada Your Equity

Non Resident Mortgage Services In Toronto My Phoenix Group

Non Resident Mortgage Services In Toronto My Phoenix Group

Non Resident Mortgage In Canada Start Here Globalbanks

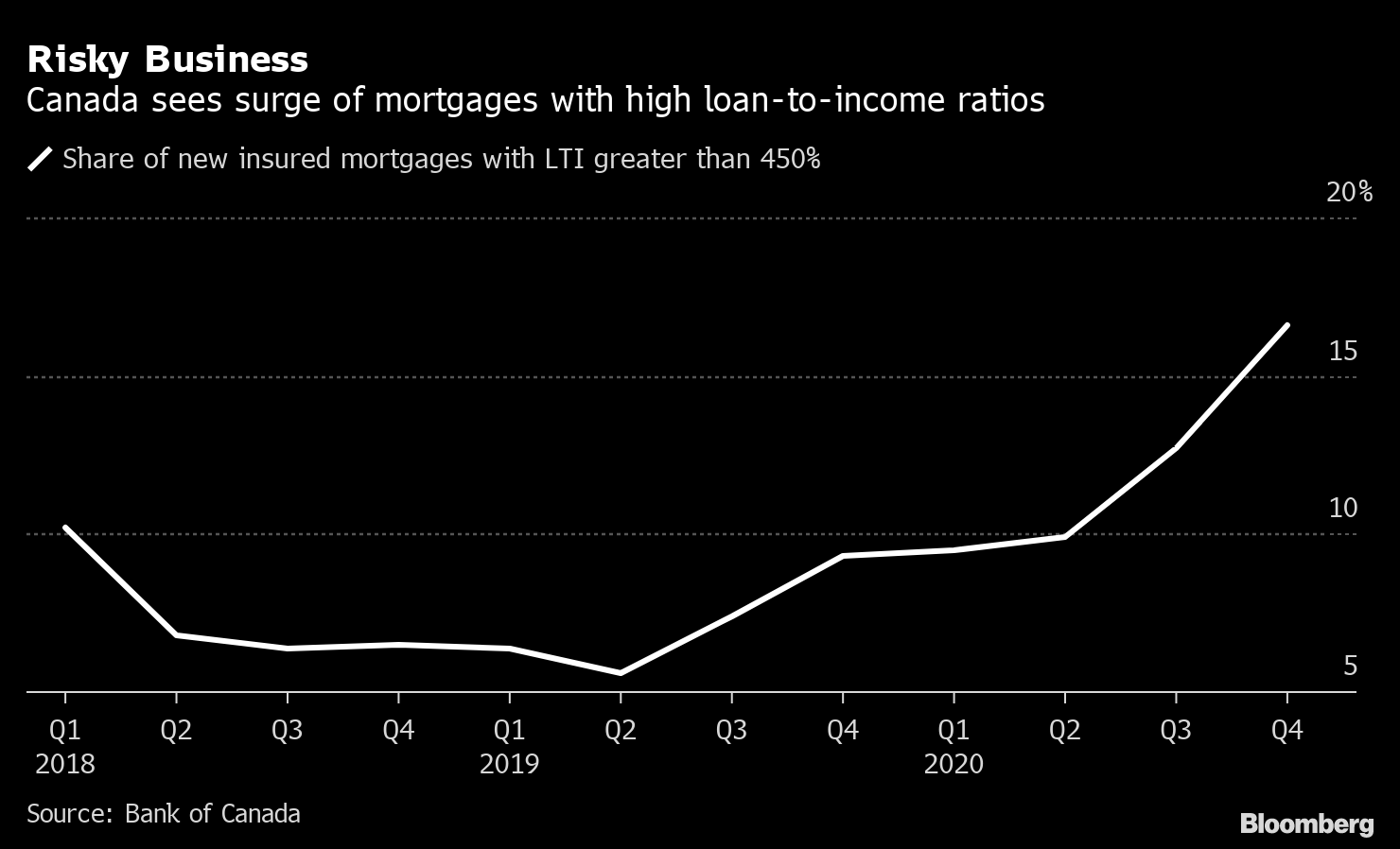

Canada S Housing Market Zero Down Mortgages Stoke U S Subprime Like Fears Bloomberg

8 12351 No 2 Rd Richmond For Sale R2728052 Strawhomes Com

Non Resident Mortgage In Canada Start Here Globalbanks

Faq For Buying Property In Canada For Non Resident Buyers The Brel Team

Xndine6hvp1p2m

Applying For A Mortgage Outside Of Your Home Country Loans Canada

How Non Residents Including Americans Can Qualify For A Mortgage In Canada Rew

Non Resident Mortgages Mortgage Broker Canada